Did you know a Chief Financial Officer (CFO) in Bangalore earns an average of ₹71.4L annually?

Now that would be sky-surfing in money, right?

Let’s bring the numbers quite down. An experienced Investment Banker in Mumbai, earns an average of ₹21.3L per annum.

We’re talking about huge figures here. Of course, you have to be a shark in the tank if you need to crunch these numbers but that is the blatant truth. Many finance professionals have made a mark for themselves in the modern world.

The finance market is expected to grow at a CAGR of 14.39% over the next five years, resulting in a market volume of US$37.19m by 2029.

So, welcome finance newbies. You’re in the right arena. A few years down the lane, and you could be pocket-filthy. However, it takes sweat, real sweat to get there.

You’ll need the right certifications, educational qualifications, and great mettle for your work. This article will talk about everything that someone who is starting to build a finance career should know.

So, stay tight, and keep reading or crunching (lol)!

The World of Finance - An Exploratory World

For the scope of this article, we’re not going to talk about how global inflation is expected to decline or the cost-of-living crisis due to international political issues. Instead, we’re going to talk about the opportunities you have as a finance student and a newbie in the world of finance.

Especially, if you’re an Indian or reside in India, you can be happy as the IMF has projected India to become the 4th largest economy in the world in 2025.

Well, for those of us in the MONEY industry in India, it’s big time.

The first important thing you have to do is ask yourself - Why Finance? Why Choose a Career in Finance - Is it just because I love money or is there some other aspect to it?

For most reasons, you would say it’s the money. That’s a good reason. In 2026, the global financial services industry is expected to generate 33,313.5 Billion Dollars, up from 23,328.7 Billion Dollars in 2021.

There are many other reasons why you can choose a career in finance. Let’s look at some.

- Diverse Career Paths - The other best factor why many students decide to pursue a finance career is the sheer number of options it offers. You can switch between job roles such as public or management accounting to investment banking or risk management based on your convenience.

- Massive Growth Opportunities - Since you’re dealing with money and funds, the ladder to finance glory depends on one factor, and that’s your contribution to the fiscal growth of your company. Within a few years down the pipeline, you can be looking at top-tier positions such as CFO, Chief Risk Officer, or Chief Compliance Officer and draw huge remuneration.

- Love Fast-Paced Environments - If you want to make it big in the world of finance, you have to love to work in dynamic and volatile environments. Because you’re dealing with money, both your senior managers and clients will tend to expect quick results. So you need to have the necessary traits of critical thinking, information processing, decision-making, and fluent communication.

- Comfortable Traveling - You need to have an appetite for traveling as some of the finance jobs might require you to move from place to place. You might also have to travel between branches of the same organization and ensure compliance measures are met in every branch.

- Passion for Upskilling - Well, upskilling in fiance careers is a must if you are going to survive. With evolutions in cloud computing, AI, IoT, and Blockchain, you need to be well adept with these technologies to maintain a strong brand profile. Mastery of these techs is necessary for specific finance positions.

Career Scope and Certifications for Finance Professionals

There are like 30+ titles that you can be entitled to in the finance industry. From generic titles like Junior Accountant, Risk Manager, etc to specific niche titles like Property Credit Analyst, you can find a whole plethora of job titles.

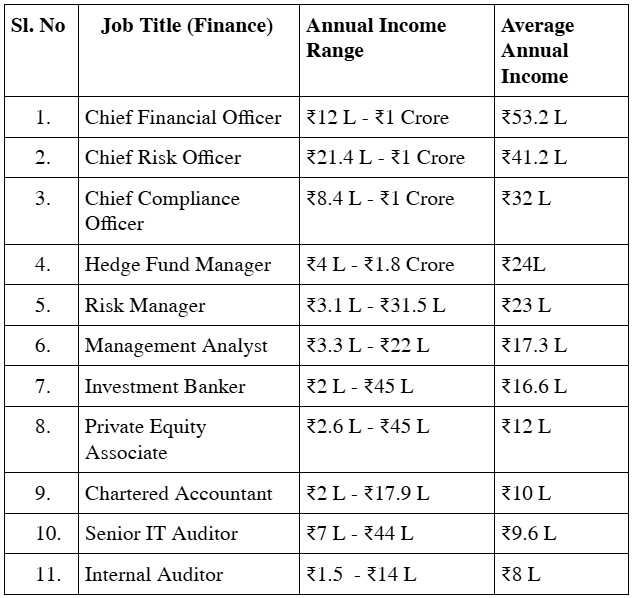

Here is a table that gives you an insight into the various finance job titles and their respective average income and range.

Source: AmbitionBox - https://www.ambitionbox.com/

Note - The Upper Limit and Lower Limit of the Annual Income Range are estimated by AmbitionBox based on a generic standard that considers multiple factors like experience, department, industry, location, and company type. These limits vary when you specify the exact parameters.

For instance, the annual income range for a Risk Manager with 14 years of experience ranges between ₹4 Lakhs - ₹42 Lakhs in comparison with the generic estimate i.e ₹3.1 Lakhs - ₹31.5 Lakhs.

When we’re talking about finance careers, we can limit the list.

Let’s look at 5 career options for a finance professional today.

1. Accounting

The most sought-after finance career of all is accounting. In India, the CA certification or Chartered Accountant batch holds immense value. Most finance students who finish class 12 aspire to become a CA given its credibility.

There’s immense scope in the accounting field as the Big 4, public accounting firms, and corporations hire skilled accountants constantly for auditing, taxation, and managerial accounting purposes.

Why choose a career in Accounting?

As a newbie, how do you decide whether you want to become an accountant? Let’s think of the basics.

- Do you like to record financial transactions?

- Are you fascinated by the idea of analyzing financial statements?

- Are you good at numbers or have an aptitude for auditing and taxation?

- Do you like to prepare financial reports and make financial decisions for your firm?

If these criteria interest you, you must surely pursue an accounting career.

Certifications and Career Options

You can choose primarily from 4 certification courses to pursue an accounting career. They are namely:

- CA or Chartered Accountant - The CA certification is the most prestigious accounting batch recognized in India. If you’re looking to build a formidable career as an accountant, auditor, finance manager, etc in India, this is the best certification.

- CMA or Certified Management Accountant - The most trending certification today in 2025 is the CMA given its scope of working within the internal management of private firms. If you’re interested in analyzing financial data to help managers in corporate companies make strategic financial decisions, this is the certification course for you.

- CPA or Chief Public Accountant - Have the desire to work in public accounting firms in the US? The CPA certification is great if you want to pursue public accounting, especially in the US. That being said, you can also work in public accounting firms in India and other countries that recognize the certification. You’ll be mostly dealing with auditing, taxation, and regulatory compliance.

- ACCA or Association of Chartered Certified Accountants - This certification is recognized in over 180 countries and with respect to this parallel, it’s a golden ticket for accounting almost anywhere in the world. It’s primarily recognized in the UK, Canada, Ireland, Australia, and the US. As a newbie in the finance world, you would like to consider an ACCA certification course given its wide range of recognition.

2. Investment Banking

Do you imagine crunching huge numbers working in the frantic commotion of the busy office corridors of Wall Street?

Well, if yes, the investment banking field is just for you. An investment banker in the US earns an average of $1,77,936 per year. In India, you could earn anywhere from 7 lakh to 1Cr+ in net revenue per year depending on your experience, skill, sector, and location.

Why choose a career in Investment Banking?

Let’s look at some criteria to decide whether investment banking is the field for you.

- Are you interested in the idea of raising capital for companies or public firms?

- Are you a persuasive speaker who likes to think like a salesman and close deals?

- Would you like to help companies in M&A transactions and leveraged buyouts (LBOs)?

- Can you deal with fast-moving work environments and handle massive client interactions?

- Do financial parameters such as valuation and cash flow analysis interest you?

If these criteria fascinate you, you must pursue investment banking.

Certifications and Career Options

- Bachelors and Masters Finance Programs - A bachelor's degree in finance is the start to a career in investment banking. Along with that, you’ll also require an MS in Finance or an MBA in a finance program to consolidate your value in the market.

- CFA or Chartered Financial Analyst - One of the most sought-after investment banking certification that will instantly give you great credit is the CFA batch. It takes rigorous effort and application to clear this exam but once you do it there’s no stopping you.

You can pursue finance positions such as Finance Analyst, Mergers & Acquisition Manager, Asset manager, Private Equity manager, etc, in the field of investment banking.

3. Financial Planning and Wealth Management

A great number of stock brokers and money handlers are in the field of financial planning and wealth management. There’s also portfolio management wherein a finance professional manages a portfolio such as shares, corporate bonds, and assets for clients.

Why choose a career in Financial Planning and Wealth Management?

Let’s look at some of the criteria needed to pursue this line of work.

- Interested in making strategic financial decisions?

- Want to explicitly work for high-net-worth clients and manage their portfolios?

- Want to help companies grow in profitability, sales, and revenue?

- Interested in upskilling and learning new methodologies for boosting the company’s fiscal policies?

If you’re interested in any of these criteria, you must pursue this field.

Certifications and Career Options

- CFP or Certified Finacial Planner - the single best choice to pursue a financial planning career is to hold a CFP certification. It’s the ultimate benchmark for global finance planning and entitles the professional to rigorous financial knowledge.

- CFA - The Chartered Financial Analyst certification is great for pursuing wealth management and gives you credit to practice as a hedge fund manager or portfolio manager and manage huge finance pools of limited and general partnerships.

4. Risk Management

During the forecast period 2024-2031, the Risk Management Market size is predicted to grow at a CAGR of 13.2% from USD 8.88 Billion in 2023 to USD 20.96 Billion by 2031.

There’s a huge scope for finance newbies to pursue the field of risk management as the market is booming and companies are actively hiring professionals who can help in managing fiscal risks.

Why choose a career in Risk Management?

Let’s look at some of the criteria essential to pursue this field.

- Are you interested in identifying potential risks and threats that could impact a company’s fiscal health?

- Do you have a logical aptitude wherein you can prioritize risks and shoot solutions to mitigate them?

- Can you come up with contingency plans consistently?

- Are you good at communication and handling multiple clients?

If you feel you identify with these parameters, you must pursue a career in risk management.

Certifications and Career Options

- FRM or Financial Risk Manager - This is the golden ticket to pursue a career in the field of risk management. By completing the FRM course and getting the certification, you become entitled to handle the various fiscal risks associated with public and private firms.

5. Fintech and Financial Technology

A promising career field for modern finance professionals, the fintech space is highly evolutionary and requires great young minds to foster creativity. The finance industry is consistently undergoing change just like the other industries and requires modern technologies to support equivalent growth.

Why choose a career in Fintech?

- Are you interested in developing new technologies for the financial market?

- Are you a problem solver who seeks solutions through technological inventions?

- Do you foresee the power of AI & Blockchain for optimizing future financial processes?

- Do you have core technical skills such as programming and financial computational modeling?

If these parameters are in your interests and skill set, you must pursue a career in fintech and financial technology.

Certifications and Career Options

- Popular Fintech Courses - You will find plenty of online finance courses that help you to ace through the world of modern-day fintech. You can do courses on DeFi infrastructure, Blockchain, Cloud-Based Accounting, AI, and data analytics. For beginners, the Digital Transformation for Financial Services (Udacity) course is great as it opens you to the world of digital platforms and finance technologies.

Learn with MyLogic Now

Cheers to all the aspirants of finance students! If you’ve read this blog, now you might be thinking of how to get these certifications and where from. Don’t worry. At MyLogic, we’ll help you decide which is the best finance course for you and help you with placement support once you’ve cleared the exam.

Let’s start your finance prep right now! Come join us.

My Logic is a pioneer in catering world-class training in financial professional courses like CMA (USA), CPA (USA), ACCA, CIMA, etc to students across the globe. We offer top-class online training videos along with online interactive classrooms that help you crack competitive finance and accounting exams.

Follow us on our website and social media channels to stay updated on the latest finance and accounting trends.